Should You Pay For Monetary Suggestions?

Should You Pay For Monetary Suggestions?

Blog Article

Possibly you had to obtain versus your retirement cost savings, you have actually altered jobs, or perhaps you have actually merely never ever begun at all. It can be overwhelming attempting to sort through the huge quantities of retirement funding and savings details. Here are some easy methods to get going with a minimum of confusion.

There are numerous stories like these 2. Your results may not be as terrific, but would not an extra $2 thousand monthly assist - a lot? You bet it would. The beauty of this is that you do not need to invest a lot of money, only your time. It will require some deal with your part, however then all rewarding things need your time and attention.

I will admit the letter did get me believing about retirement. I examined our Retirement Strategy in my mind. We had begun it when I was 30 and it was doing fine. I had actually made all of the contributions that were required and so had the business I had worked for. The life span when I started this was 73. Still a long method away. I was thinking about early retirement however I understand I could wait till 65. Let's face it that would give me 8 great years of retirement.

Calculate costs and start conserving - Child rearing will undoubtedly affect your budget. Examine your financial scenario to retirement planning see to if you can manage it. Also bear in mind of your household expenditures and your objectives for your child. It is likewise important to begin conserving as early as possible as the costs will certainly increase as the child gets older.

This party planning info will drive most all of the choices you need to make going forward with your preparation - food, home entertainment, supplies, etc.

Siegel retirement plannings informed me that hedge funds will offer their portfolios back to the banks to pay their debt and there were huge corrections that happened in the market as an outcome. Siegel states that is what was driving the marketplace.

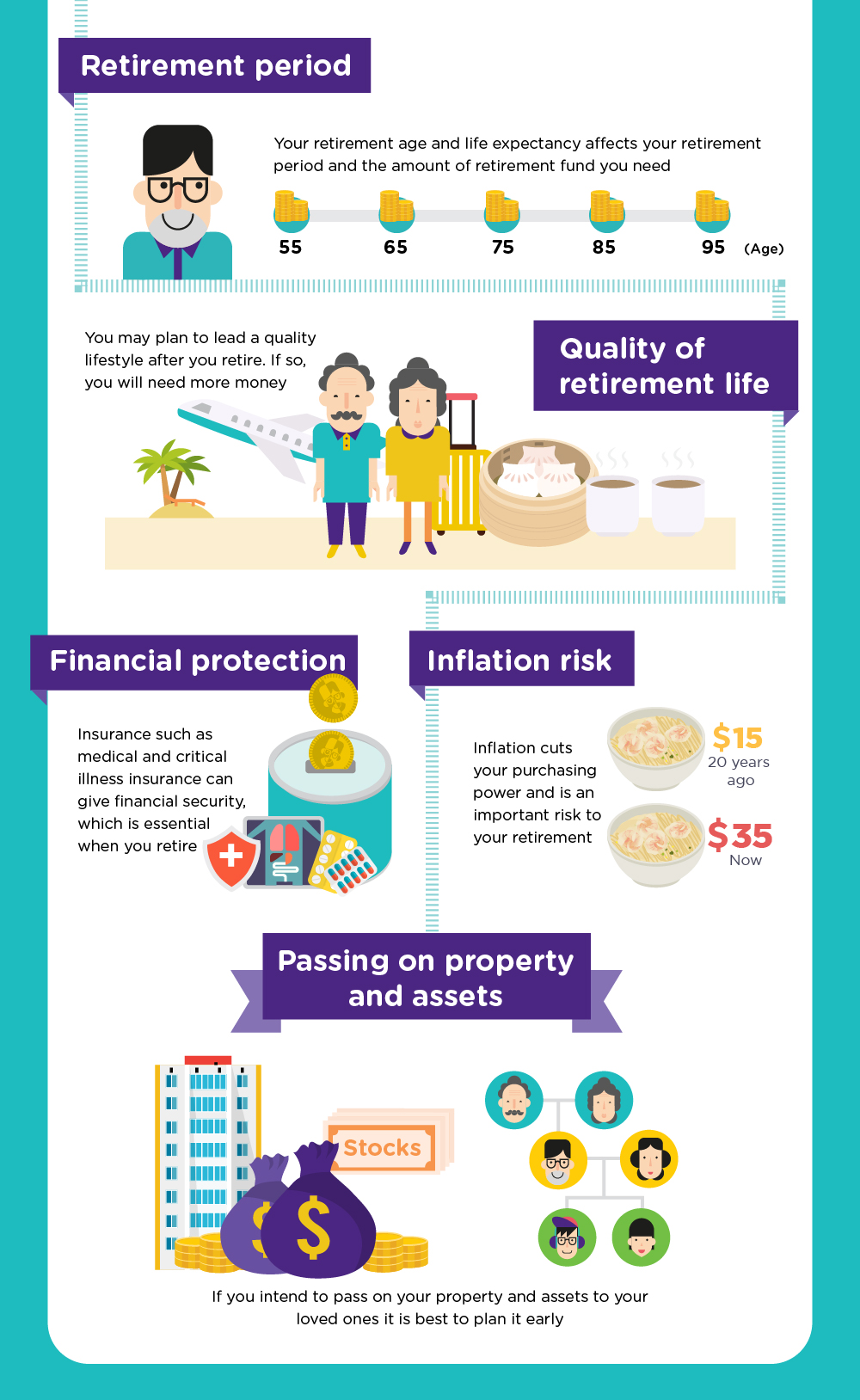

Developing your monetary position is simply the first part in your extensive monetary plan. Income taxes, insurance coverage, retirement preparation, education planning, investment preparation and estate planning are other aspects you will desire to include. As you can see, establishing your comprehensive strategy can take a great deal of time and energy but in the end, will be well worth the effort.

Sure, you can relax, and perhaps even commemorate after lastly taking the step towards collecting funds for your future! Nevertheless, you do not wish to ignore it. You need to regularly make an effort to remain up-to-date on things that connect to developing a future that counts.Please view this post on my page listed below, where you can discover a list of resourceful websites for retirement planning.

Report this page